Blanket Loans: A Better Business Option

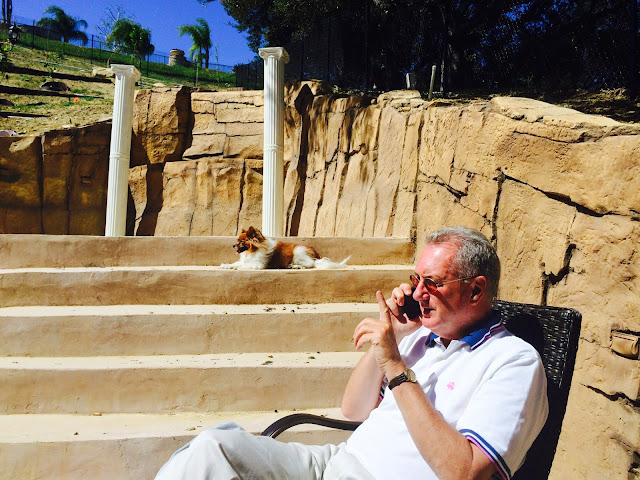

Meet Peter J. Burns III, the founder of Burn$ Funding.

If

you need funding for you need a business or personal, Burn$

Funding has

the best solutions for you. Because he has worked with lending institutions

with deep pockets for decades, Burns is able to provide unique financial

opportunities. He also has worked spent years building relationships with

credit-building organizations, which allows him to help you repair your credit

and receive more money based on your credit score.

This article gives a closer look at blanket loans: a creative, effective tool that Peter J. Burns III can use to help you get the money

you need quickly, improve your credit score, and stay out of debt.

Blanket Loans from Burn$ Funding

Burn$

Funding now

offers clients blanket loans, which provide the opportunity to secure growth

capital by consolidating multiple loans into all-encompassing. If you own

multiple properties, blanket loans are an awesome opportunity for you --

regardless of whether you are an entrepreneur or a passive investor with a

traditional full-time job.

Consider

the benefits that a blanket loan, also known as a blanket mortgage, has to

offer:

- Reduced

interest rates.

The

interest rates of individual loans are often higher than the interest rates of

blanket loans. If you are looking for a better interest rate, a blanket loan

can help. Think of the additional capital you could have access to by

decreasing your interest expenditure. Blanket loans can help you manage your

money, as opposed to spending it on the accumulated interest.

- Simplified

borrowing.

Blanket

loans also simplify your loans because they allow you to work with fewer

financial institutions. This is an important aspect for investors to consider

because it helps entrepreneurs and passive investors to save their valuable

time. As you know, the more properties you own, the more time you end up

juggling a complicated mix of various interest rates, and terms, and

requirements. Securing a blanket loan from Burn$ Funding can reduce or

eliminate the need to deal with the variety of considerations and limitations

which affect borrowers who work with multiple lenders.

- Increased

cash flow.

Selecting

a blanket loan option from Burn$

Funding helps

to give you a dramatically increased cash flow and provides access to more

capital-raising opportunities. The ability to boost income is an extremely a

major consideration for both entrepreneurs and passive investors.

Why Burn$ Funding is Better

If you are wondering why you should work with Peter J. Burns III, consider his unique background and mission. Burns has started over 150 profitable startups and using his business expertise, he has helped thousands of other entrepreneurs to thrive.

Burns’s

history and focus mean that:

- Burn$ Funding

is not a traditional bank.

This

business was created by an entrepreneur, for entrepreneurs. Make the sensible

decision when it comes to the health of your enterprise: choose to work with an

authoritative master of the business industry who understands your needs.

- Peter J. Burns III

can get you the ideal deal.

He

has spent a lifetime building relationships with lenders. getting you the best

deal possible. Lending organizations are more willing to work with an

individual with whom they have already established trust. This means that Burns

can offer better rates and larger loans than most entrepreneurs could hope to

receive on their own.

- You

will have access to the full package.

Aside

from blanket loans, Burn$

Funding

offers a vast array of business solutions, including bridge loans, credit card

stacking, and even a credit card which was specifically developed for

entrepreneurs. (Read more about the Entrepreneur’s

Credit Card Program

here.)

Testimonials from Real

Entrepreneurs

If

you still aren’t convinced, read these testimonials from individuals who are

reaping the benefits of choosing blanket loans from Burn$ Funding:

“Within

weeks, Burn$ Funding consolidated the loans I had on multiple investments

properties into one note at a very attractive rate.” - Dr. Raul Carrillo.

“I

had more than a dozen loans on properties that had been acquired over the past

decade. The note was very complex, and it required a great deal of work on the

part of the Burn$ Funding team. Each step of the way, they

exhibited a level of professionalism that was off the charts.” - Dr.

Cliff Janke

Learn

more about Peter J. Burns III by visiting his website www.peterjburnsiii.com and find out about more business

solutions at www.burnsfunding.com.

Article

by L.K. Bright, MLS & MLIS